How to Set Up SMART+ER Goals with 12-week Objectives

The Neighborhood Finance Guy writes about financial literacy topics: SMART+ER Goals Series, Financial Planning, Budgeting, Millennial Money Management, Investment strategies and more. The goal is to help you make effective and impactful decisions with your time and money. The information is free but the struggle is not sold separately. And, if you are into this sort of thing; the blog is PLUTUS nominated, I studied Accounting with a Specialization in Taxation, served in the U.S. Marine Corps and now work as an Auditor. I’m also big on Traveling and watching Anime.

Table of Contents

7 steps to achieve SMART+ER goals – with examples

By February, most people give up on their resolutions. Somewhere in between the high hopes and energetic false starts, the truth sets in. It is not a new you. Instead, it is the same you at best.

Why do most fail while others succeed?

One word – “Planning.”

Designing a well thought out vision and establishing a great plan are worth their weight in Crypto and NFTs

Officially, I start planning for the next year, the November prior.

Progress waits for no one. It takes a while to construct a 3-year vision.

The vision has to be grand enough to aspire you to get up in the morning. It has to be so entrenched in your daily journey that you cannot help but achieve it while feeling empty if you skip out.

The value of setting the tone is underrated. The Creative Economy has created a false sense of value for labor. Instead, most are stuck living fake proxy lives through hours of scrolling.

How do you pivot?

Most of the work happens in your mind way before you see the impact in your life.

So how do you get there?

Human beings need to feel like we are working toward a goal. To get there, requires effort and objectives. If you are not using SMART+ER goals with 12-week objectives, you are holding yourself back while casting a vote to be mediocre. You will fall short of your objectives.

However, you will be 400% better off than the average person.

So what are the seven SMART+ER Goals?

If you get to December and your goals remain unfulfilled, you did not draft goals with strategic objectives that are clear, measurable, and attainable. Unlike ideas that are vague, overly optimistic, overzealous, under developed or unplanned – SMART+ER goals places you at the finish line and onward to the next race.

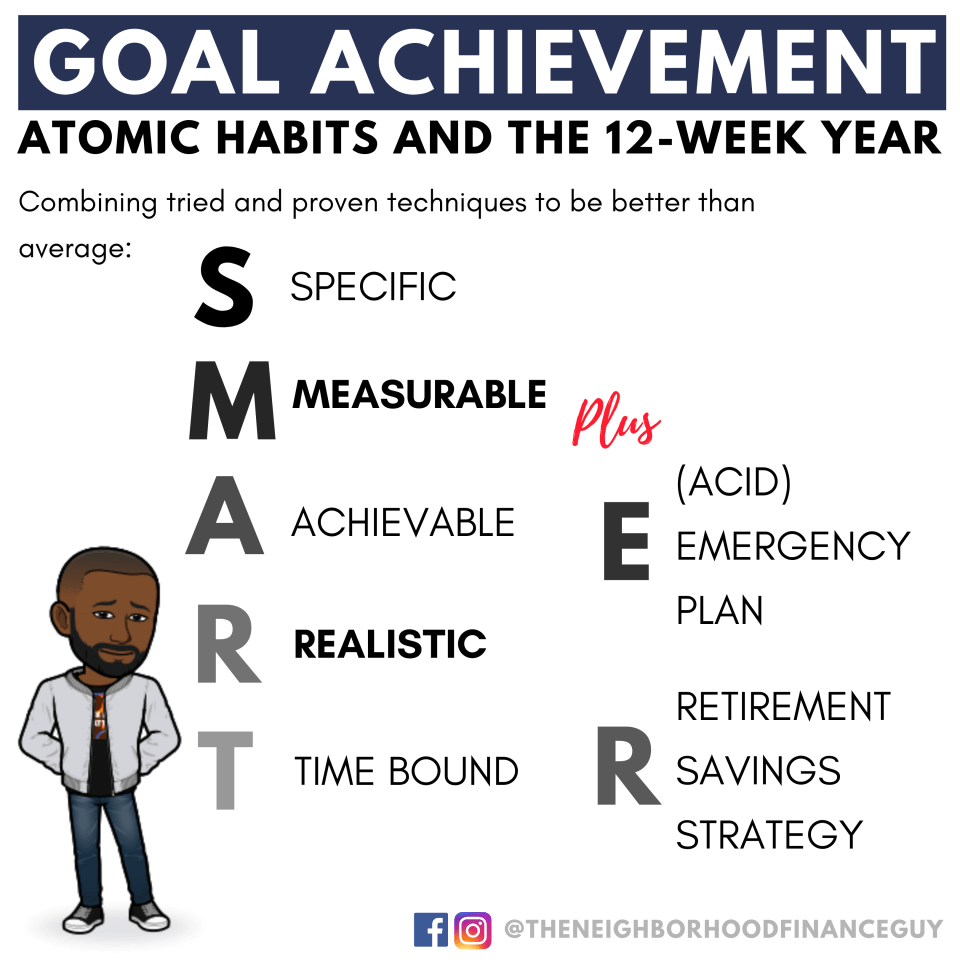

SMART+ER is an acronym that outlines strategy and vision through objectives.

The primary purpose is to align your life with purpose. The original SMART goals are Specific, Measurable, Achievable, Realistic, and Time Bound. However, I added +ER which accounts for the unknown while preparing for the future.

The “E” stands for having an (Acid) Emergency Savings Plan and the “R” for enacting a Retirement Investment Strategy. Too often, people start small businesses, end up semi successful and shackled to the job with no retirement in sight.

More commonly, when things go bad without an Emergency mitigating strategy, many lose it all trying to keep a sinking boat afloat while drifting toward jagged cliffs and shark invested waters.

1. Be more SPECIFIC with your goals

Merely saying you want to be rich or you want to earn more is too vague. Instead, hit the notepad and pick an income that you would like to earn. After that, pick a time frame.

Go even deeper and pepper the details a bit.

For example, do you want to be a six-figure earner or do you want to earn six-figures after taxes? Do you want to start making $150,000 per year, $500,000 or even $1 million? Want to increase your cash flow by X percent (instead)? Do you want to make X number of sales per month? Are you more of a real estate portfolio? How many units in year one?

Set a clear focus for your desired path, like a GPS location.

2. Benchmark your success. Always make the objectives MEASURABLE

SMART+ER plans involve Starting Objectives and an End Goal.

If your goal isn’t measurable, you can’t objectively say you’ve achieved it. Continuing with the prior examples, a specific goal is measurable. You can use Mint.com or Personal Capital to track your cash flow per month. You want log in your sales numbers automatically with Intuit’s QuickBooks.

Did you make it yet?

This is the fun part of the journey where you can benchmark monthly, quarterly, semi-annually or annually. Just like a person that’s trying to lose weight or gain muscle in the gym, you want to start tracking your efforts and even what you eat to get an accurate assumption of what you can improve.

So are you holding up to your 12-week objectives? Are your objectives leading you toward your goals?

Don’t be afraid to check the numbers again.

3. Start Shifting toward ACHIEVABLE goals with Atomic Habits

Many household are extremely active with full calendars, and yet they are going nowhere. Why? They never set any specific or measurable barometers so they are aimlessly living life by events on a calendar.

Setting an achievable goal means choosing objectives are attainable. This doesn’t mean that they are easy, conversely they need to be challenging but doable. For example, you want to run a marathon by 30. You are now 25 and can barely go around the block.

For a 12-week goal, you can start with three achievable objectives. Cut the coffee and Drink more water. Get quality sleep. Wake up to walk or run the block.

For the next 12-weeks you can focus on running a 5k at the end. This way you are gradually progressing forward while gaining confidence.

If you pick a goal that, you know it crazy i.e. losing 10lbs in a week, you will fail and it won’t add any value nor any constructive move toward your end goals. If you’re currently earning $20,000 as a cashier, applying for the Regional manager might not be a good fit.

Use SMART+ER goal setting to ensure you can achieve real progress.

4. Be REALISTIC vs Prosperity Wishing

Only extraordinary efforts will earn you extraordinary results.

In order to achieve your goals, devise realistic objectives that get you to the finish line. You do so by working on your daily 1 percent habits. If you never played the guitar before, don’t expect to be the next Guitar Hero.

The time you take to plan creates the path. So take a mental note of where you are going. You can dream but time (awake) ultimately creates mastery.

Most know what they need to do to change, but never commit to the process.

For example, we know that eating too much leads to poor health and weight gain, but more than two-thirds of adults in the US are overweight or obese. We know that living paycheck to paycheck is not fun but most still struggle with living beyond their means and on interest-loaded debt. Again, you already know what you need to do to reach your monetary goals.

Make sure you make time to execute your goals while transforming dreams to reality.

5. SMART+ER goals are TIME-BOUND

Setting a clear time-frame is another key catalyst in achieving your goals.

Give yourself a reasonable amount of time to accomplish your goal. Graduating college in 3 years might seem extreme but with a realistic plan and time specific effort, you can definitely construct a plan that’s attainable for you.

Will you get promoted in the next 9 months?

Maybe, it depends on what you do from now until then. Time you put into a goal or a project matters. It’s like a tree. You can do all the prep work for the right nutrients and conditions but you have to set a realistic time to measure the results.

If you don’t reach your goal, it’s perfectly fine to reassess.

Was your objectives achievable, measurable and realistic? Did you allow enough time? Did you put in maximum effort?

When you use SMART+ER goals acronym to map out what you want, there’s nothing wrong with re-setting your goals until you get to the finish line.

6. Covers your (Acid) Emergency Plan

Murphy’s Law states that anything that can go wrong will go wrong… and at the worst possible moment.

Nothing derails a good plan faster than a “what if” experiment in real time. This is why I added the “E”. Make sure that you incorporate an Acid emergency plan by making sure that you are stable financially.

This will stretch your timeline a bit but will ultimately help you avoid catastrophic resets. Every good plan should be laced with contingencies. Before you start a business, build your savings up to at least one-year’s worth of expenses. Financial stress wrecks people and homes.

7. Never leave home without s Retirement Savings or Investment Plan

The final principle in defining your SMART+ER objectives and goals includes a Retirement Exit Plan.

While it’s OK to dream, dive into the reality that the average American is retiring broke with as little as $250,000 saved for retirement and $1,500 per month for social security. With anticipated retirement expenses of over $60k, most retirees have seven years tops.

Creating SMART+ER goals account for the present and the future. If you want to be solvent and you want your life’s work to yield more than ten hours watching streaming content, I would suggest you highly consider your retirement goals.

Play the game SMART+ER!

About Author

2 Comments

Pingback:

Pingback: